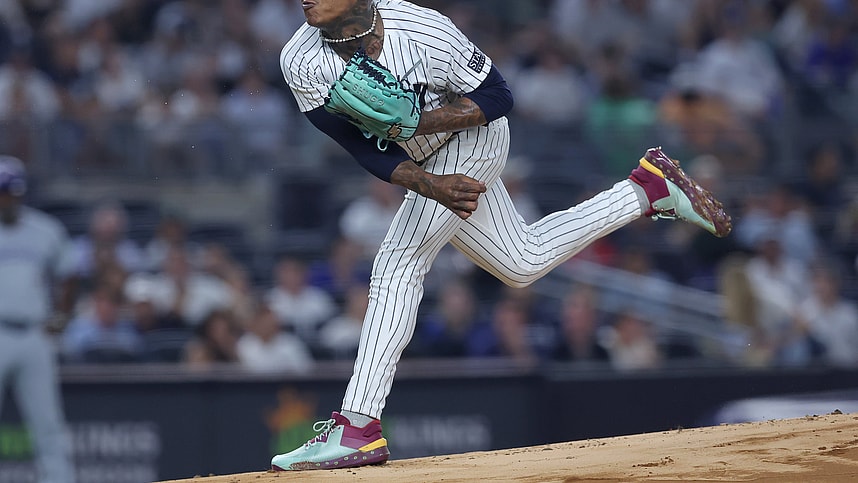

The Yankees are stuck between a financial rock and a hard place. With their estimated luxury tax payroll sitting at $303.2 million, they’ve already crossed the dreaded fourth tax threshold of $301 million. Adding another significant contract is out of the question unless they shed salary first. Enter Marcus Stroman, the 33-year-old starter who, unfortunately for the Yankees, may now be more of a liability than an asset.

Declining Performance and Velocity Woes

Stroman’s performance in 2024 painted a troubling picture. He pitched 154.2 innings with a 4.31 ERA, a respectable but far cry from the consistency expected of someone earning $18.5 million. His strikeouts plummeted to a career-low 6.58 per nine innings, and his ground ball rate dropped nearly 9%, a stark contrast to the numbers that once defined his game.

The most alarming issue, however, is his declining velocity. Stroman’s average fastball velocity dropped from 92.2 mph in 2023 to 90.6 mph in 2024, signaling that his age and workload might finally be catching up with him. For a pitcher who relies on pinpoint control and generating weak contact, losing velocity adds another layer of concern.

The 140-Inning Dilemma

The Yankees also have to contend with the contract’s built-in landmine. If Stroman pitches more than 140 innings in 2025, a player option for the 2026 season will automatically trigger. For any team taking on Stroman, this means not only inheriting his current salary but also managing his innings to avoid being locked into another year. It’s a balancing act that limits Stroman’s trade appeal, making an outright salary dump unlikely.

A Difficult but Necessary Move

General manager Brian Cashman finds himself with limited options. The Yankees are not in a position to sweeten the pot with a prospect, but packaging Stroman with a mid-level farmhand might be their best bet to move his contract. Even then, they’ll likely have to eat a portion of the $18.5 million, just enough to make him palatable to a suitor.

Cashman’s offseason moves have been handcuffed by Stroman’s contract. It’s no secret the Yankees want to make another significant acquisition—whether that’s a big infield bat or additional pitching depth—but they can’t realistically pursue anyone else without first clearing Stroman’s salary.

A Deal Waiting to Happen

Time is of the essence. Every day that Stroman remains on the roster is another day the Yankees are stuck in financial limbo. Finding a trade partner won’t be easy, but there’s always a market for starting pitching, even if it’s a reduced version of Stroman. The Yankees just have to be willing to take the hit.

In an offseason where every move matters, unloading Stroman’s contract could be the domino that sets the rest of their plans into motion.

More about: New York Yankees